Contents:

You should only trade in these products if you fully understand the risks involved and can afford to incur losses that will not adversely affect your lifestyle. The Head and Shoulders pattern is a trend reversal indicator that predicts bullish to bearish and bearish to bullish reversals in the forex market. Price action reversal patterns like wedges, double top and bottom, and head and shoulders patterns occur when an opposite trend follows an uptrend or downtrend. Trending waves that follow a strong trend or momentum in either an upward or downward direction.

A candlestick will display the high, low, opening and closing prices of an asset over a specified period. You can set your timeframe, whether each candle represents a month, week, day, hour or just a minute. After years of appreciation, by July 2011 the Australian dollar was trading above 1.10 level. However, after reaching such an impressive peak, the AUD entered into a downtrend which is running for 9 years and so far there are no visible signs of its end. Nowadays the AUD/USD trades near 0.65 level, which represents more than 40% decline, compared to 2011.

- This is what’s known as a ‘trendline support’ – this differs from traditional support levels because it should rise or fall in line with the trend.

- And just like everything we’ve discussed up to this point, it’s incredibly simple.

- However, a level is not a particular price value; it is rather a zone in the chart, so you should consider both the candlestick shadows and closing prices.

- On most platforms, a candle with a higher closing price than an opening price is green in colour , whereas a candle with a lower closing price than its opening price is red .

- You should not try to learn all known combinations immediately.

- Nowadays GBP/USD trades near 1.24 mark and tries to break above the 50-day simple moving average.

However, after that very long downtrend began, which lasted for no less than 10 years. Obviously, during this long period, traders using price action trading strategies to trade Forex had plenty of opportunities to earn some decent payouts. So basically, this Forex price action strategy involves an analysis of several charts. Obviously, not every single currency pair is engaged in a trend. Some pairs are moving sideways and have settled for ranged trading.

Accumulation into A New Trend

Demand areas occur where buyers have entered the market aggressively. If the price returns to that level, traders will be watching to see if the buying picks up again, pushing the price back up. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

You can open a forex price action strategy once the second candlestick closes or after a confirming candlestick has formed . The first candlestick is a mother bar, it has a big body. The second candlestick forms within the range of the first one and doesn’t go beyond the mother candlestick with its high and lows. When the price is trading flat in a price range, there are always the upper and the lower borders of the range.

Forex Price Action Trading Lessons

The next candlestick closes above the 50% Fibonacci retracement level of the first candle. Expect the pattern to complete at the end of an uptrend. Expect the tweezers pattern at the end of a downtrend. Expect the tweezers pattern at the end of an uptrend. As you see from the above example, the pattern is quite simple and easy to trade, even if you are not a professional. I identify a double bottom candlestick within this correction, it is marked with purple.

A shorter timeframe will generate more signals, but they will be less profitable. The above chart displays a moderate downtrend in the XAUUSD. Let us look at the first descending impulse that started on March 8, 2022, and finished on March 29, 2022. Level 100% is at the high of March 8, level 0% will be at the low of March 29.

Stop Loss Hunting Strategy and Secrets – DailyForex.com

Stop Loss Hunting Strategy and Secrets.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

By observing asset prices, traders should quickly be able to tell what phase of price action the market is in at that moment. It should be born in mind that the M5 timeframe refers to short timeframes with a lot of market noise. It often happens that as a result of this noise, the price forms several different Price Action patterns near the level, sometimes touching it, sometimes going beyond it. If you put a stop loss with some margin per level, you can avoid its false signals. To mark the levels, one should consider the price highs and lows, followed by a reversal.

These reoccurring price patterns or price action setups reflect changes or continuation in market sentiment. In layman’s terms, that just means by learning to spot price action patterns you can get “clues” as to where the price of a market will go next. As mentioned before, sometimes currency pairs settle for range trading and there are no visible signs of any trend. The support stands near the lowest point of the recent price action, where the price does not fall below this level. The resistance level is located at the high points where the given currency has not risen above that mark. After identifying those two points, traders can draw two flat lines to make support and resistance more visible on the chart.

“What’s the point of learning the 4 stages of the market?”

The M5 timeframe provides time to think over and plan trades. One could apply all Price Action patterns covered above, but they should be traded at the levels marked in the 5-minute timeframe. Other popular combinations to trade with price action are the Fibonacci levels, and price channels, VSA analysis, margin zones, option levels, indicators-oscillators.

Best Forex Trading Strategies: My Guide to the Forex Market – InvestingReviews.co.uk

Best Forex Trading Strategies: My Guide to the Forex Market.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

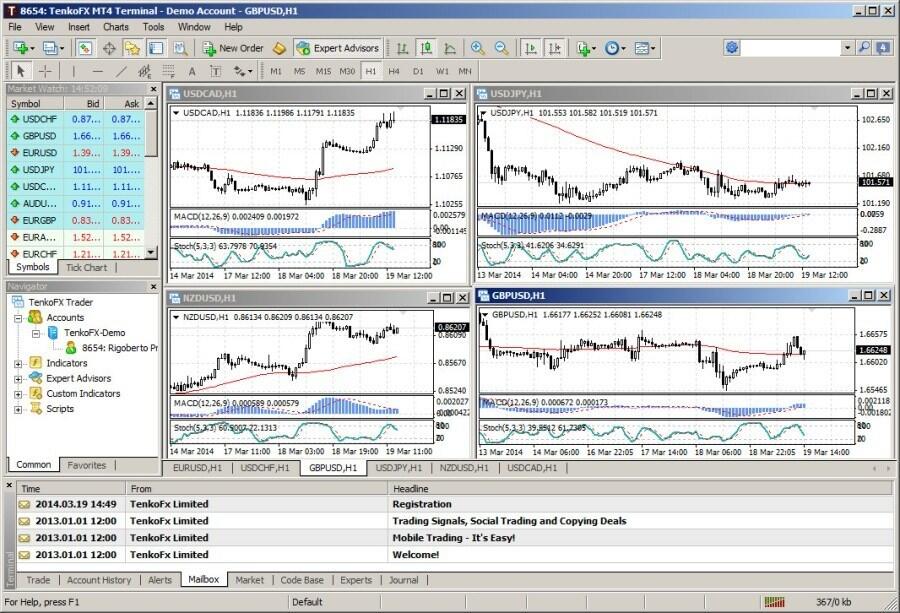

Price Action in trading means looking for price chart patterns based on Japanese candlesticks. Candlestick patterns can give a clue on the future price movements. Price Action patterns help to determine entry points and stop-loss levels and make profits from trading. Indicator trading strategies somehow ease the work of a trader, making calculations automatically. Displaying the analyzed data in a convenient form on the screen. Thus, the trader has visibility, which helps to discover patterns in the chart and make profits.

Who Uses Price Action Trading?

Even for those of you who already know this stuff, the simplicity illustrated by the charts above is a good refresher. The amount of time between these points can range from a few weeks to a few months. I have been trading these patterns for more than seven years, and in my experience, it makes no difference. It’s no coincidence that this is also where most Forex traders slip up.

- It can be used on a wide range of securities including equities, bonds, forex, commodities, derivatives, etc.

- She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands.

- Which indicates either the low price or the high price being rejected.

- You can also set the take profit according to your trading strategy or at a strong resistance level.

- It isn’t for everyone, and it’s important that you find a style that suits you.

As the name suggests, the head and shoulders pattern is a market movement that looks a bit like the silhouette of a head and shoulders. In other words, prices rise, fall, rise even further, fall again, and rise to a lower high before a modest drop. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Taking your signal bars on a 5 minute chart would cause many many stop outs before one would work out, simply because of the noise.

Things You Didn’t Know About Successful Forex Traders in 2023

Great explanation with systematic flow of information to make the reader feel the logic of every step coming after another in a harmony of knowledge stream. It is not because you give it FREE to us but what you have posted in this web and youtube channel is very value and helping me so much to understand the strategy. Im glad to find your web today, Im looking for Price Action Trading Strategy to improve my knowledge and sharpen my analyzing on chart. So if for example i look for area of value/true S&R, this would cover almost two yrs. I want to know whether one need to keep the overall market in mind before getting long or short in a Stock. Thank you for your time and effort to share your trading experiences.

I really found the part on volatility expansion and contraction interesting. It’s something I often look for myself when studying the charts. This is one of your best posts so far, it will help both beginners and remind experienced traders. If the market is in an uptrend, you look to buy only.

Identify hidden opportunities, master risk management,

The breakout buildup can be part of any price pattern and it then acts as an add-on, improving the overall pattern quality. Some traders may refer to it as a pressure pattern, but the idea is the same. The distance between the two lows that I marked at the bottom is also very small, further indicating a loss of bearish momentum. During a healthy downtrend, you generally want to see that the price is making new lower lows quickly.

An inverse head and shoulders strategy is used to indicate a bullish reversal, signalling that the downtrend is going to end and the uptrend will begin. A flag is a corrective wave with a specific shape as shown in the screenshot below. The flag occurred within a downtrend and after a strong bearish trending phase.

Even weak reversal patterns become strong if there is a tweezer. If the chart displays a reversal pattern between the tweezers candlesticks, the pattern is seen as a strong one with confirmation. The hammer candlestick should stand out from the others, as it has a long lower shadow that extends beyond the neighbouring bars. I also want to stress that the hammer candlestick forms only at the chart lows; you should not trade a hammer within a developing downtrend or in the middle of a swing low. Both candlesticks of the pattern are roughly equal and stand out from other candlesticks in the chart.

Thank Teo for the priceless information you are just giving away. So are making a killing from useless strategies but you are just taking everyone on board for free. My you be blessed and continue to share your valuable knowledge with us.

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malhttps://forexhero.info/ data. There are leading indicators and there are lagging indicators. The indicator is based on a mathematical formula, so there can be no errors in the calculations. If you need to calculate the fractional zones 1/2 and 1/4, then the values obtained above, according to the formula, are divided by 2 or 4.

The troughs and peaks of trendlines float between lines of support and resistance on a price chart. Price action describes the characteristics of a security’s price movements. This movement is quite often analyzed with respect to price changes in the recent past. When a bearish pin bar forms, a price action trader would usually back the sellers again, believing it’s a sign the market is going to reject the move higher. They can either enter straight away or wait for a confirmation signal in the next candle.

Comentarios recientes